Without a title insurance policy, a commercial property investment could be vulnerable to potential issues and claims. Personal insurance provides coverages for individuals to tackle personal losses due to injury, accidents, or damage to properties, whereas commercial insurance offers insurance products for varied business protection needs.

How to get Real estate leads on craigslist The ultimate

Massachusetts commercial property insurance can be found through a local adviser.

Commercial property insurance guide. Personal insurance has been the golden child. Typically, natural disasters, such as earthquakes and floods, aren't covered by commercial property insurance unless a business adds it to its insurance policy. Commercial property or commercial landlord insurance is protection for property owners who are letting out to 3rd parties for commercial use.

Property coverage is a necessity for any business. Property insurance helps protect the same physical assets as personal property insurance, including damages caused by fires, storms, and theft. Property insurance can be complex, period.

Crime there are two parties involved with a property insurance contract: Your tenant is the business, organisation or group who has a rental agreement in place legally allowing them to inhabit your property. It’s important to determine the property you need to insure for the continuation of your business and the level of insurance you need to replace or rebuild.

How to calculate commercial property insurance rates must take into consideration property value and future earnings potential. Commercial property insurance coverage varies, but they’re generally classified by the type of event leading to a loss, and by what things are insured. At face value, commercial property insurance (also known as commercial property and casualty insurance) seems relatively straightforward.

4 results found, sorted by affiliated products first. They have access to several carriers so that you get the best rates in town. Commercial property insurance includes the following.

According to a recent report on property insurance , the impact of recent natural disasters will greatly affect commercial property rates in the coming years, particularly when it comes to property and assets located in areas at risk for wildfires, floods, and hurricanes. Business property insurance covers your buildings, the contents within those buildings, and loss of income if you’re out of business due to a claim. It safeguards the property your business owns and leases, such as furniture, equipment, inventory, and fixtures against loss or damage when a fire, theft or another type of disaster strikes.

Commercial property insurance plans pay for losses based on the replacement cost of the item or its actual cash value. Commercial property insurance is used to cover any commercial property. Commercial property insurance helps protect your business’ property and company.

Protecting additional insureds, loss payees, mortgagees, and builders risk insureds; This coverage is important for companies that own or lease a physical location or rely on equipment to run their operations. Since not all companies provide specialist coverages, you need.

For more, read our full guide on commercial property insurance cost. Replacement cost (rc) refers to the amount necessary to repair, replace or rebuild property on the same premises, with comparable materials and quality without deducting any amount for depreciation. Learn more about what commercial property insurance is and what it covers.

With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests. Think of it as homeowner’s insurance for your business. Compare commercial property insurance that covers the building your business is in and offers the liability options you need.

(1) the insured, and (2) the insurance company. Annotations building and personal property coverage form What does commercial property insurance cover?

Assessing the risk associated with a commercial property involves looking at many complex and sometimes interrelated factors. It can also pay some of your lost income if your business is unable to operate normally. Commission earned affects the table's sort order.

Basic property insurance usually covers losses caused by fires or explosions, theft, vandalism and damage from vehicles or airplanes. Typically, commercial property insurance covers: Your guide to insurance for mixed use commercial property.

Commercial property insurance guide commercial property insurance pays to repair or replace your building and business property damaged by a fire, storm, or other event covered by the policy. The basics usually insurance premiums for business properties are set by multiplying the value of the building and its contents by a value that the insurance company comes up with suitable level of risk. In the course of doing business, anything can happen.

Commercial property insurance can be sold separately as an individual line policy (referred to as a monoline policy), or it can be sold as part of a commercial package policy (cpp), which combines two or more commercial coverage parts such as commercial property, general liability, and commercial auto. Commercial property insurance protects commercial property from such perils as fire, theft, and natural disaster. Commercial property insurance covers a business's physical assets from fire, water damage, storms, theft, and vandalism.

Buildings you own or lease (including permanent fixtures, permanent machinery, and permanent equipment). Buildings you own or lease as a part of your business, your business personal property, and the personal property of others make up the basic coverage sections of commercial property insurance. Connect with an independent insurance agent for quotes today.

What is covered under commercial property insurance? We wrote this guide to help insurance raters and underwriters learn more about some of these factors, particularly those related to our work. Property insurance protects the contents of your business against fire, theft and other perils.

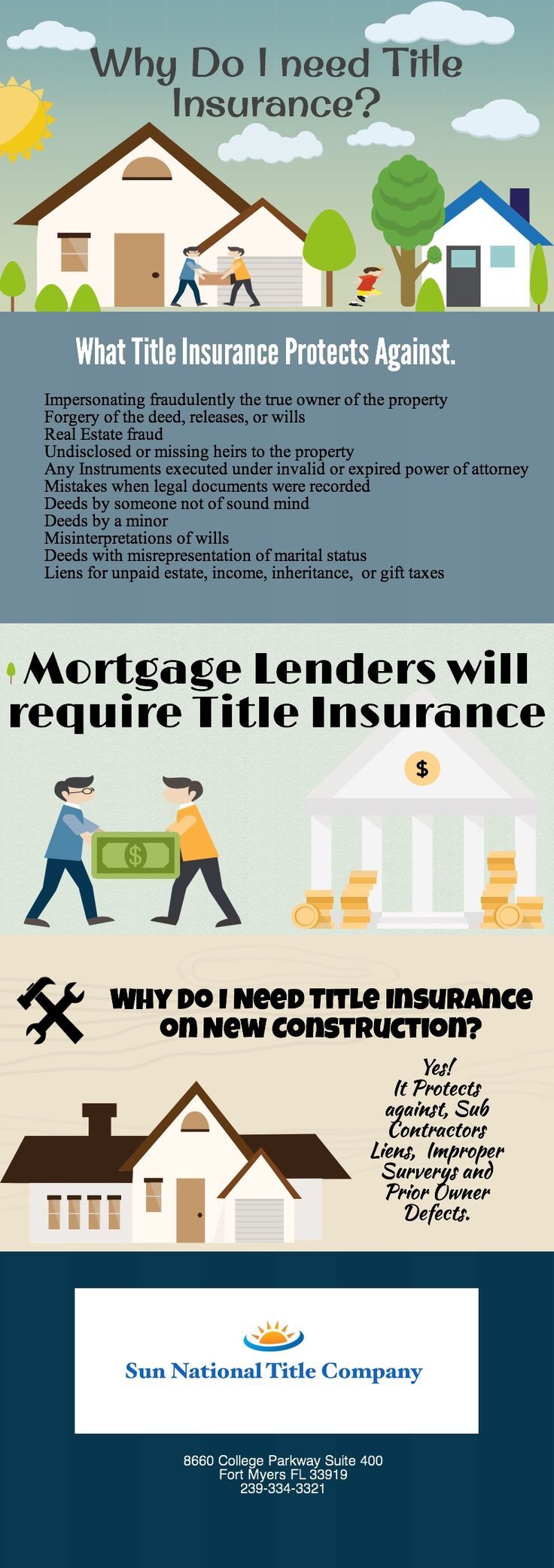

For example, if someone does file a claim on a property, even if it's an illegitimate claim, the owner may have to pay for the legal fees required to defend their ownership rights (not to mention the time and headaches associated with handling legal issues). How we order our comparisons. You may need to add additional coverage for property that isn't attached to your building (like vehicles, signs, or outdoor fences).

It can help protect your business in case of unexpected accidents or tragedies like fire, theft, wind damage, or even a building’s collapse under the weight of snow. There are many different types of property insurance and levels of coverage available. Commercial property insurance protects your business against damage to buildings and their contents from fire, theft, and other hazards.

If your business suffers a loss or damage from a fire, a theft, a storm, a plumbing disaster, or other physical destruction, a commercial property policy will protect your property and its contents.

mortgage insurance blog MortgageInsuranceTips in 2020

Innovation Property Solutions Innovation Group North

Rental Property Tax Benefits Rental property investment

Creating Your Insurance Plan infographic (With images

Our public adjuster always ready for helping you.mercury

Do I need Commercial Auto Insurance? guide and tips for

insurance for everyone Insurance, For everyone, Calm artwork

7 Easy Rules Of Progressive Renter Insurance progressive

Apartment Flooded? Here's What You Need to Do (With images

With just a small amount of personal information

Online shopping for Mobile Case with free worldwide

Property insurance Fort Myers Piktochart infographic

Understanding Triple Net Lease (NNN) Properties

Home Based Business Tax Forms in Home Based Business

The USAA household checklist for helping to avoid

Carrier Representation and Partnership Carriers

Renter's Insurance update needed flyer! Apartment

Guide for professional liability insurance

Property and Casualty Insurance Concepts Simplified The

Post a Comment

Post a Comment